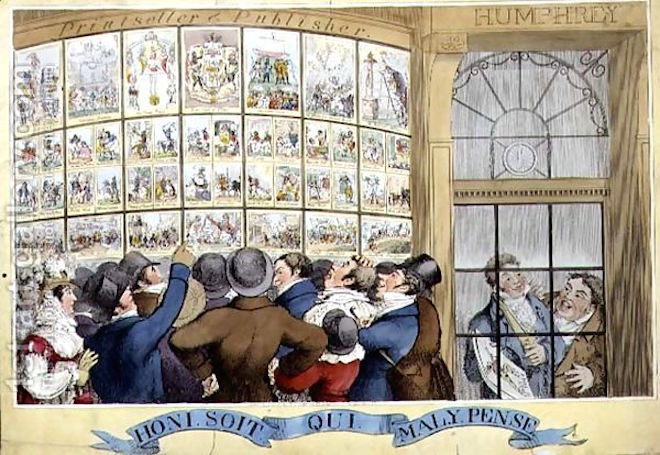

Honi Soir Qui Mal Y Pense ... Dyson Heydon on "taste", being "Australian", and the "mood" of the nation ... Transcript of Lady Di Fingleton trial reveals she is a bossy boots ... Freehills wanting its client to correct and withdraw ... Lodging tax returns is a matter of "integrity" ... Timely tax compliance by NSW barristers climbs from 56 to 97 percent ... From Justinian's archive, September 8, 2003

WHAT a warm and fuzzy guy is Dyson Heydon. The pulsing vibe of his touchy-feelyness shone through in a recent interview he granted to Honi Soit, the University of Sydney student organ.

Asked, “what does the term Australian mean to you?” Dyse replied:

“Technically, a subject of the Queen in right of Australia. That leaves out, I suppose, aliens of various types who have been resident here for a long time. In a sense, they are Australians too. They are partly Australian.”

You’d be hard pressed to get a more romantic vision of “Australianess” than that.

There were other gems.

Honi: How would you describe the mood of the nation?

Dyse: A little depressed, a little fearful, but with those qualifications basically confident.”

Honi: Could (the High Court’s) decisions in some way, contribute to defining that mood?

Dyse: Unpopular decisions can increase the depression of the nation.

Whereupon the newest High Court justice waded into the difficult swamp of public “taste”:

“It’s almost impossible to conceive of a tyrant or a sovereign with sufficient power to change some of the things that I would change. For example, there’s a kind of levelling down in public taste and the intelligence with which issues are discussed in the press or on television and indeed, the way in which matters are discussed between people.”

And could the High Court make a difference?

“Yes, because in however limited a way, a difference could be made. The aims of the High Court judges in the past have attempted to improve public taste. People who might be appointed to the court in future, could in theory, cause it to deteriorate.”

Thank god Dyse is there to stop the rot.

Bossy Boots in the box

Lady Di: thinking about Basil

Lady Di: thinking about Basil

While Lady Di Fingleton has been whiling away the hours in a fetching prison-issue, dove-grey tracksuit, Theodora has been pouring over the transcript of her trial, which has just come to hand.

The cross-examination by Margaret (Killer) Cunneen makes compelling reading and may explain why the jury didn’t exactly warm to the Qld chief magistrate. Here are a few pearls:

Fingleton: My secretary would never allow me to meet with him [Magistrate Walter Ehrich] unless she was sitting outside the door.

Cunneen: So your secretary gave you a direction not to meet with this particular magistrate without her there to protect you; is that right?

Fingleton: I always do what my secretaries say.

But a bit later she’s soon re-established authority over the wretched secretary:

Fingleton: I think you should never be rigid or inflexible, and if I get a good idea I put it in as long as I can sell it, which I do, and as long as I make it clear, which I do ... I update this all the time. I sit my secretary at the computer and I dictate the latest discussion and the latest changes so that it’s up to date.

Just as one is being swept away by Di’s flexibility and open-mindedness, she gets narky when magistrate Basil Gribbin attempts to add something to her agenda for a coordinating magistrate’s meeting:

Fingleton: It’s a very serious matter to try to interfere with my agenda. It was undermining my authority.

Which takes us to what she means by “authority” and her understanding of “first among equals”:

Fingleton: I understand it’s a fashionable term. I’m not talking about we’re not all equal intellectually, we’re not all equal personality-wise, we’re not equally experienced, but the equality is that of respect.

But let’s not beat about the bush on who’s really the boss:

Fingleton: I decide everything for the Queensland magistracy. I choose to consult. I take full responsibility for it. I choose to consult them. They talk me out of some things and agree with some things. As I think the judge said in the civil case, I could choose magistrates with blue eyes.

And never far from the surface is Fingleton’s haunting “Basil Problem”:

Cunneen: Don’t you find, if you feel a conflict with a colleague, that if you speak to them about it, get it out into the open, it dissipates to some degree and stops festering? Don’t you find that?

Fingleton: Usually.

Cunneen: Why didn’t you try that with Mr Basil Gribbin?

Fingleton: May I think a moment as to why I didn’t?

She’s still chewing on that one.

Please explain!

It’s pleasing to see that in his hour of need One Nation Svengali David Ettridge is looking to a lawyer of Asian ancestry to save his bacon on appeal.

Queensland barrister of Burmese blood, Andrew Boe, has taken on Ettridge’s case, which is amusing when you remember that if One Nation had its way there’d be no Asian immigration.

The old warhorse Cedric Hampson QC has saddled up to look after the awful Pauline’s appeal. He is instructed by Chris Nyst, the Gold Coast solicitor who did the trial.

Both Nyst and Hampson have published popular paperback potboilers of the crime genre.

Froth from Freehills

Gulson: Freehills wanted client to withdraw allegations about "document retention" scheme

Gulson: Freehills wanted client to withdraw allegations about "document retention" scheme

The editors at the House of Fairfax must have been a bit cranky about the wordy epistle received from Freehills on behalf of Clayton Utz’s monk in residence, Father Brian Wilson.

The complaint was about articles reporting the affidavit sworn by Frederick Gulson, a former corporate counsel and company secretary for WD & HO Wills, now called British American Tobacco Australia Services.

Gulson claimed that “everyone in the know” realised that the strategy of the cancer stick manufacturer was to get rid of all sensitive documents “under the guise of an innocent housekeeping arrangement”. Gulson was also approached by Freehills to see whether he could assist Fr. Wilson vindicate his reputation. He replied saying that as far as he was concerned Justice Eames’ findings matched his own recollections.

Freehills partner Keith Steele signed the letter to the editors of The Sydney Morning Herald and The Age. He demanded corrections and the withdrawal of certain “suggestions” contained in reports of Gulson’s affidavit.

But hang about. Doesn’t Freehills earn a small fortune acting for Fairfax day in and day out doing defamation and corporate work?

Someone at Fairfax must have told Steele to execute his own withdrawal because there was a singular lack of any correction, modification, clarification, or grovel in either of the organs in question.

Simpson J has a (Fried)gut-full

While Freehills is fresh on our lips, we would be remiss to neglect Justice Carolyn Simpson’s remarks in the NSW defamation case of Ezzo v Grille (August 21).

Freehills’ solicitor Mark Friedgut acted for the plaintiff, Gary Ezzo, a South Carolina author and “parent educator”. The defendant, Robin Grille is a child psychologist who apparently said something beastly about Ezzo in an article called, Fundamentalism: a war against children. It was published in two magazines and on the internet. Corrs is acting for the defendant.

Grille sought from the plaintiff security for costs to the tune of $40,000, and that was the point at which Simpson J got into the act.

The judge observed that while in general the tone of the defendant’s correspondence was “measured”, the same could not be said of the correspondence emanating from Freehills, by which she means Mark Friedgut.

His letters to the defendant possessed an excitable quality. For instance, he said the imputations contained in the article were “false and pernicious” while publication by the defendant of a letter, “oozes with malice”.

Another epistle said the content of the publication was “despicable” and when Robin Grille claimed that he relied on the publisher to undertake normal legal checking, this was characterised by Friedgut, "as perverse as it is cowardly".

Justice Simpson was not impressed, nor did she have much time for the “generous offer” from the plaintiff to provide security for costs on condition Freehills received affidavit evidence of the defendant’s defences. As the judge put it:

“To require the defendant to embark upon that process before any steps have been taken towards the resolution of the first question (whether the imputations arise and are defamatory) would be inconsistent with what has been done by the legislature.

I do not, therefore, regard the plaintiff’s offer as generous and it does not operate to persuade me that the discretion should be exercised in favour of the plaintiff and against the defendant.”

No tax return - no integrity

Meagher: unmoved by barrister's plight

Meagher: unmoved by barrister's plight

One message comes through loud and clear from Roddy Meagher’s pithy little judgments in NSW Bar & Grill v Andrew Hamilton Young: not to file income tax returns bespeaks a lack of integrity, and a lack of integrity in a barrister means getting booted off the jam roll.

No explanations, no matter how heart-rending, will suffice. And Young put forward some pretty compelling reasons, including: the death of his son by drowning in 1985, two failed marriages (with disadvantageous property settlements), a failed liaison, at least two failed business ventures that cost him an arm and a leg.

That should have melted the heart of the flintiest protector of barristerial integrity.

Paul Brereton, for Young, also pointed to the following list of worthy, and non-controversial, attributes possessed by his client:

- He did not indulge in a lavish lifestyle.

- He did not enjoy high levels of discretionary expenditure.

- He did not accumulate any assets in his own name or in the name of other people.

- He is personally generous.

- He is now destitute and bankrupt.

- He has never deliberately understated his income.

- He has always helped the poor and the ignorant.

- He has often provided his services free of charge.

- He was not motivated by greed.

- He has no convictions.

- Removal of his name from the roll will remove a great force for good.

Roddy said Young had achieved “some eminence” in the field of criminal law and seems to have done well financially. In 1985, for example, his gross income from the bar was at least $350,000.

All of the above was overpowered by the undoubted proposition that Young did not file a single income tax return from July 1, 1980 to November 28, 1996. Between July 1, 1980 and June 30, 2000 he did not pay “a penny’s worth of income tax”.

For a time the Ippster was swayed by Brereton’s forceful submissions, saying: “I have considerable sympathy for Mr Young.” He represented the less well off and did so, “to the admiration of his peers”.

But because of the non-filing “for so many years”, he has been “undone by his neglect of his own affairs”.

This suggests that if he had failed to file returns for somewhat less than 16 years he might have had a chance. Maybe that variable will be settled by the Court of Appeal in the forthcoming Clarrie Stevens’ case.

Foster AJA also was “not unmoved”, particularly as Young “did not follow a deliberately premeditated plan of tax evasion in order to amass wealth at the expense of the community”.

However, his hand was tied by the Court of Appeal decisions in Cummins and Somosi.

Further tax related murk

Before departing the realm of lawyers and their tax there are a couple more excitements to mention.

The Weekly Tax Bulletin reports the Senate Estimates hearings on the Australian Tax Office and its legal profession compliance program, which was established in 1997 and is still running with a staff of 22. The ATO started looking at NSW lawyers, but its gaze went national last year.

In fact, it is now the turn of Victorian lawyers and the tax man has approached the Law Institute asking for information about its members. The LIV declined to produce this information, saying to do would be a breach of its privacy policy.

The ATO was referred to the custodian of the register, the Legal Practice Board, who seeing it had nowhere to hide, decided to hand over the information sought.

The ATO also told the Senate Estimates Committee that nationally there are over 900 barristers, and around 6,000 solicitors, with outstanding tax debts.

However, the lodgement rate has improved dramatically. Over the last three years lodgement of returns on time by barristers in NSW has gone from 56 percent to 97 percent.

The ATO reports 10 cases of bankrupt barristers, plus another 12 related parties, before the courts.

As at May 14, 2003, 14 barristers and solicitors in NSW had managed to go bankrupt - twice.